AcadTax Series

13 Aug 2025 | 3.00 p.m. to 4.30 p.m. | Zoom

Balancing Digital Taxes and Geopolitics: The European Dilemma

Register Now!

Join us for an insightful seminar with Dr. Leopoldo Parada as he examines "Balancing Digital Taxes and Geopolitics: The European Dilemma".

While current geopolitical complexities have led many to dismiss the possibility of an EU-wide Digital Services Tax (DST), Dr. Parada will explore whether this option remains viable through a balanced, four-pronged approach that includes a clear commitment to international frameworks or a complete depart from them, an EU-wide coordination that avoids discriminatory pitfalls, and the use of strategic diplomacy.

Dr. Parada will also analyse the feasibility of using Europe’s Value Added Tax (VAT) system as a superior alternative to an EU-wide DST. Despite certain limitations in B2B contexts and redistributive effects, Dr Parada argues that VAT offers compelling advantages over a DST through its non-discriminatory nature, existing harmonisation across Europe, and trade neutrality.

Join us as we explore these critical options shaping Europe's digital taxation landscape!

Session agenda:

-

Introduction

-

The evolution of DSTs in Europe

-

Tariff Tensions and the Feasibility of an ‘EU-Wide DST’

-

Broadening Europe’s Path Forward: Can EU VAT be the ‘hidden gem’?

-

Final remarks

-

Q&A

Admin Details

This event will be conducted via Zoom.

Date and Time: 13 Aug 25, 3pm to 4.30pm

Fee: $109 (incl GST)

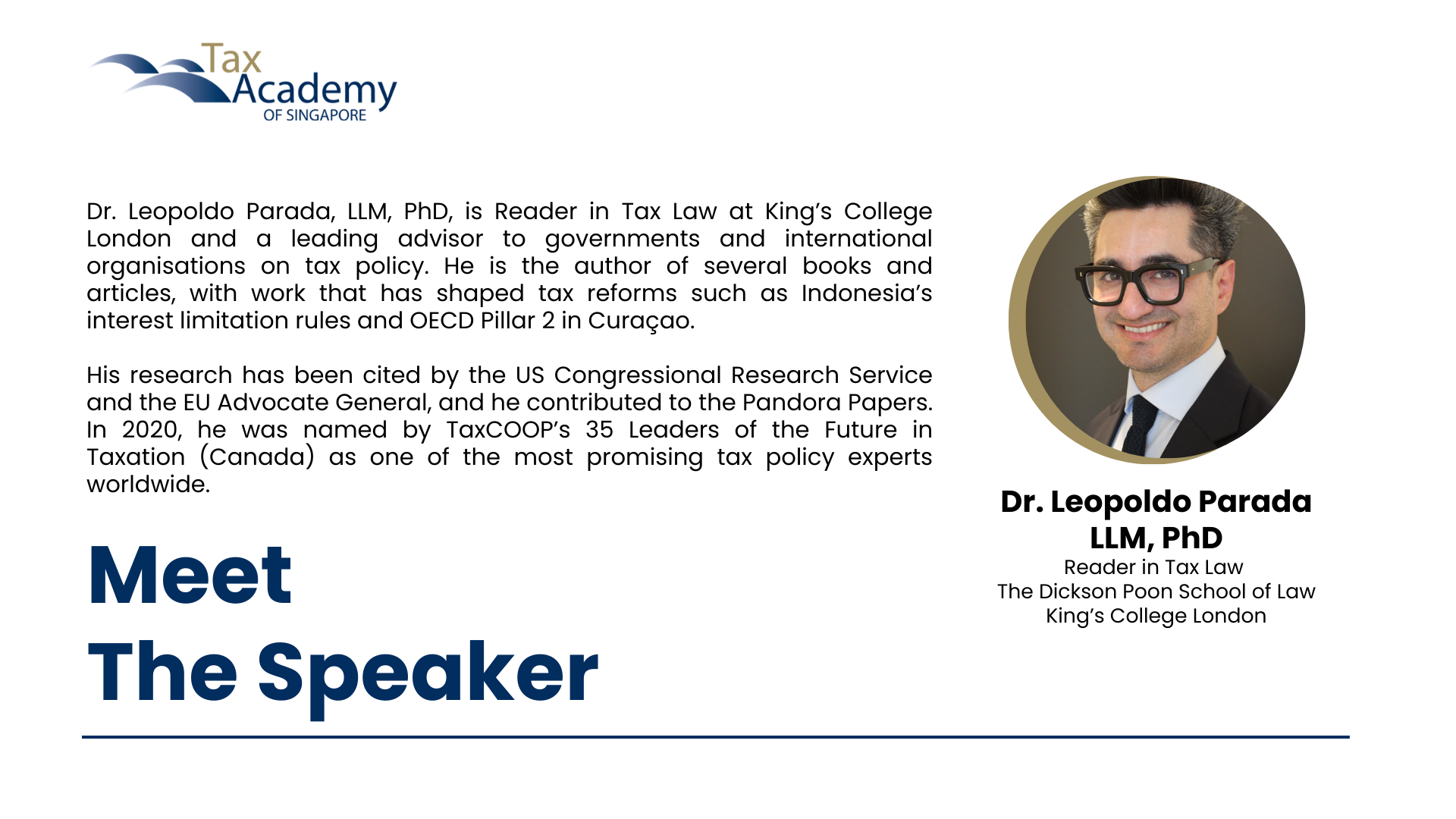

About the Speaker

12 Aug 2025 | 3.00 p.m. to 5.00 p.m. | Revenue House Discovery and Courage Rooms

Global Tax Reform and Trade Tariffs - China's Perspective

Register Now!

Join Professor Zhu Yansheng, Professor of Law at Law School, Xiamen University as he examines China's approach to emerging global tax frameworks and complex tariff issues.

In this session, Professor Zhu will focus on:

Agenda highlights:

Impact of recent tax reforms on cross-border investments and multinational enterprises operating in China

-

China's strategic role in global tax governance

-

Impact of tax reforms on MNEs operating in China

China's response to global trade tensions, tariff measures, and implications of recent US tax legislation developments

Admin Details

Date and Time: 12 Aug 25, 3.00pm to 5.00pm

Fee: $109 (incl GST)

Venue: Revenue House Discovery and Courage Rooms

Refreshment will be provided

About the Speaker