Law 101 for Tax Professionals Series

22 Aug 2025 | 2.00 p.m. to 5.00 p.m.

Company Law

Register Now!

Join us for this in-person seminar conducted by Mr Ng Pei Tong (Head, Mergers & Acquisitions and Capital Markets at Covenant Chambers LLC) and Mr Yang Shi Yong (Director at Drew and Napier LLC) who will cover the following:

-

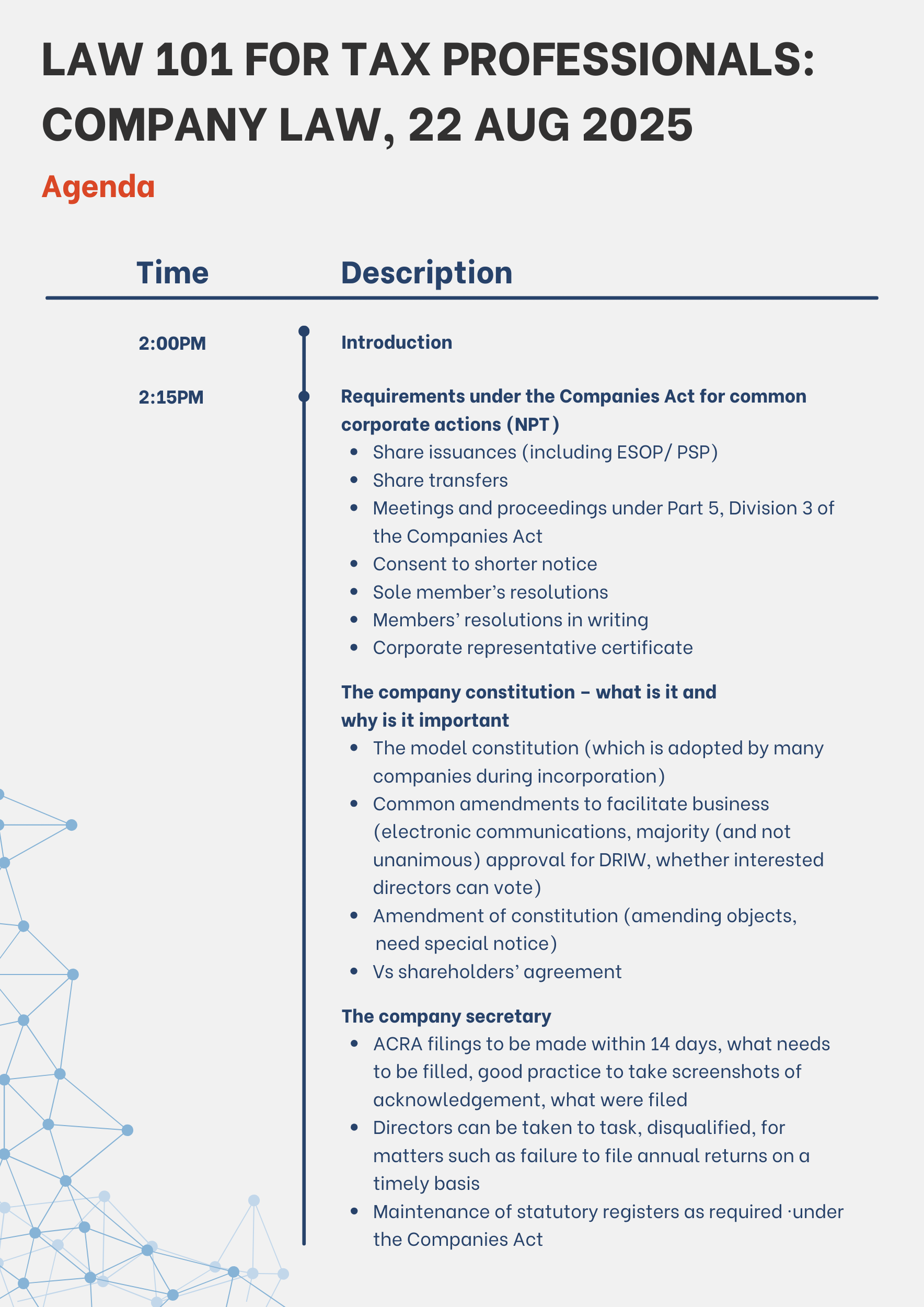

Requirements under the Companies Act for common corporate actions

-

The Company Constitution – what is it and why is it important

-

The Company Secretary

-

The Company Directors

-

Re-Domiciliation

-

Amalgamation

-

Requirements on Financial Statements and Audit under Part 6 of the Companies Act

-

Directors’ Duties

-

Various Case Studies

Agenda

About the Speakers

Admin Details

This seminar will be conducted in-person

Date: 22 Aug 2025

Time: 2.00pm to 5.00pm

Venue: Revenue House Discovery and Courage Rooms@B1

Fees: SGD 163.50 (incl. GST)

Registration is on first-come-first served

27 Jun 2025 | 3.00 p.m. to 5.00 p.m.

Employment Law

Join our speakers from Baker McKenzie Wong & Leow – Ms Esther Pang (Senior Associate, Employment) and Ms Samantha Tan (Senior Associate) as they provide an overview of the employment lifecycle and related tax implications from an employer's perspective.

Agenda

Hiring of employees

An introduction into the requirements

that employers should keep in mind when hiring employees in Singapore

Managing employees

A brief discussion on the common

issues that arise during an employment relationship, including performance

issues and misconduct

Termination of employment

An introduction on how an

employer should go about terminating the employment of an employee in Singapore

Tax applications in the employment context - common issues that arise

Labelling termination payments as "ex-gratia" or "severance"

Issues

relating to employees working remotely

Admin Details

The webinar will be conducted via Zoom

Date: 27 Jun 2025

Time: 3.00pm to 5.00pm

Fees: SGD 109 (incl. GST)

Registration is on first-come-first served

10 Jan 2025 | 3.00 p.m. to 5.00 p.m.

Tax Crimes and Money Laundering

Join us in this webinar, where our speakers Mr Charles Li, Director, Law Division at IRAS and Mr Yang Shi Yong, Director at Drew & Napier LLC, provide an overview of the offences and penalties under the tax Acts and Penal Code for tax evasion. Money laundering associated with tax crimes, and measures to combat international tax evasion, will also be discussed. There will also be a brief review of the cases on tax crimes in 2024.

Agenda:

-

Introduction to criminal law

-

Some key offences under the Income Tax Act, Goods and Services Tax Act and Stamp Duties Act

-

Cheating, fraud, forgery and falsification-of-accounts offences under the Penal Code

-

Tax-related money laundering offences under the CDSA

-

Exchange of information and mutual legal assistance regimes

-

2024 in review

About the Speakers

Charles is a Director in the Advisory & Litigation 2 branch of the Law Division in the IRAS. He is an Advocate & Solicitor (Singapore) and a Fellow Chartered Accountant (England & Wales), with both private and public sector experience in tax law. He has experience in tax litigation, prosecution and advisory work across the different types of taxes and duties. He has also been a trainer for Tax Academy, and an adjunct lecturer at SMU, since 2021.

Shi Yong is a Director at Drew & Napier’s Tax & Private Client Services department. He advises on a range of tax law including corporate and personal income tax, goods and services tax, property tax, stamp duties, and customs and excise duties, with specialisation in Singapore enterprise tax risk management, tax audit, and tax investigation matters. He is recognised as a recommended lawyer for Tax by the Legal 500 Asia Pacific and has also authored various tax related legal publications.

Admin Details

-

This webinar will be conducted via Zoom

-

Date: 10 Jan 2025

-

Time: 3pm to 5pm

-

Fees: SGD 109 (incl. 9% GST)

-

Registration is on first-come-first served.

16 Jan 2025 | 3.00 p.m. to 5.00 p.m.

Overview of 2024 Tax Cases

Join us in this webinar as Mr Vikna Rajah, Partner and Executive Committee Member, Head of Tax & Trust at Rajah & Tann Singapore LLP shares insights on four notable tax cases from 2024. Gain valuable perspectives on these recent rulings and their potential implications for Singapore's tax landscape.

Cases to be discussed:

-

GIO v CIT [2024] SGITBR 1

-

GIP v CIT [2024] SGITBR 2

-

THM International Import & Export v CGST [2024] SGHC 97

-

Changi Airport Group v CIT [2024] SGHC 281

About the Speaker

Vikna Rajah, Partner at Rajah & Tann Singapore LLP and member of its Executive Management Committee, leads the firm’s tax practice. Recognised as a “Leading Individual” in Tax since 2017 by Legal 500 APAC and Chambers, he is lauded for his “deep technical expertise,” “acute commercial acumen,” and ability to “make the impossible possible.” As a leading Tax lawyer, his landmark win in the second-ever GST case before the Singapore High Court was recognised as “Impact Case of the Year” by the International Tax Review. He also successfully led the firm to win Singapore Tax Disputes & Litigation Firm of the Year.

Admin Details

-

This webinar will be conducted via Zoom

-

Date: 16 Jan 2025

-

Time: 3pm to 5pm

-

Fees: SGD 109 (incl. 9% GST)

-

Registration is on first-come-first served.