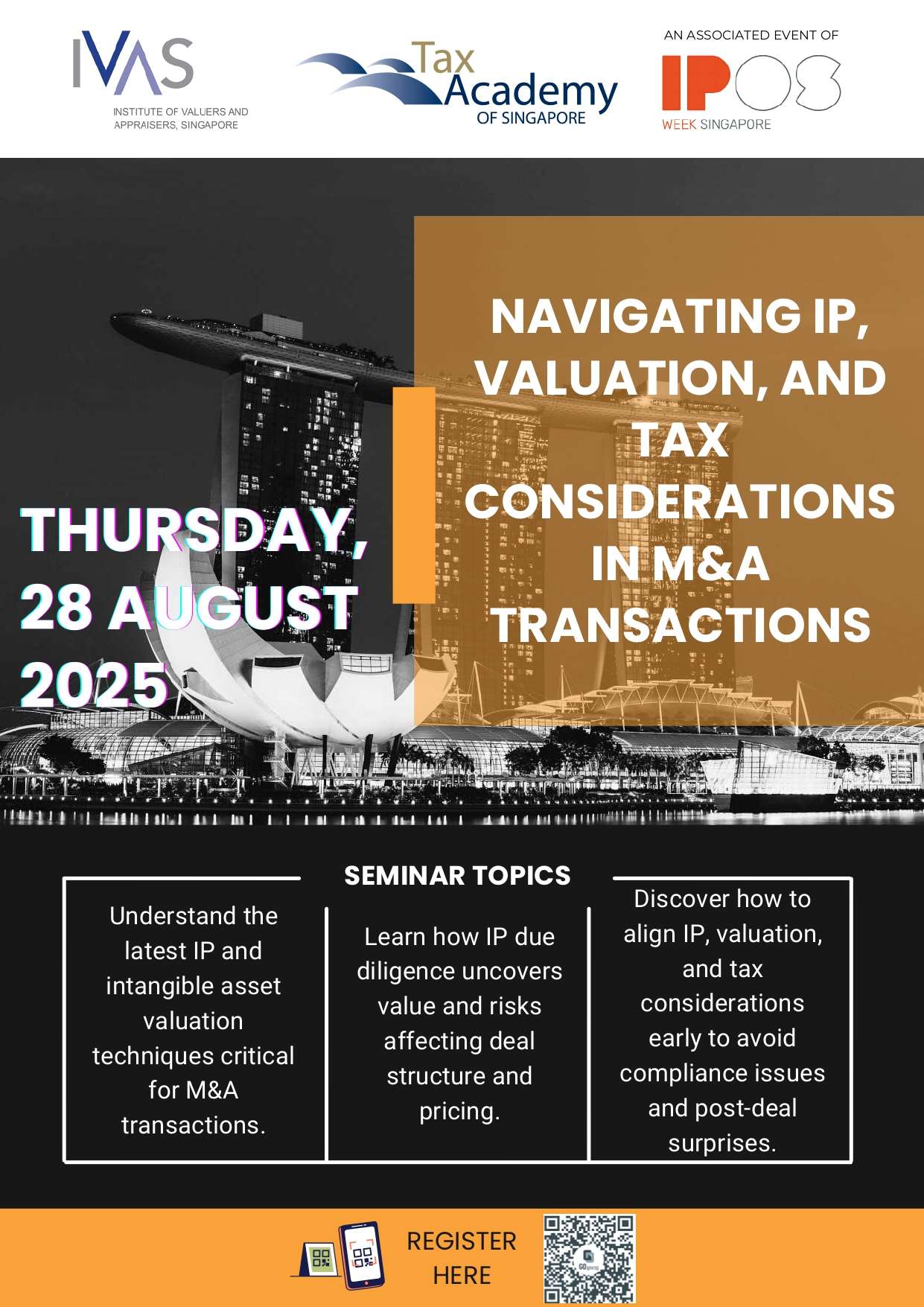

Navigating IP, Valuation, and Tax Considerations in M&A Transactions

Navigating IP, Valuation, and Tax Considerations in M&A Transactions

28 Aug 2025 | 2pm to 5.45pm | Revenue House Auditorium

Register Now!

Mark your calendars! In a first-ever partnership, Tax Academy and the Institute of Valuers and Appraisers, Singapore (IVAS) present a must-attend seminar on "Navigating IP, Valuation, and Tax Considerations in M&A Transactions" on 28 August.

As intangible assets (IA) increasingly drive deal value in today’s economy, understanding how intellectual property (IP) / IA is assessed across legal, valuation, and tax domains is more critical than ever. This seminar brings together leading experts to explore how IP due diligence, valuation, and tax considerations intersect in M&A deals.

Whether you’re structuring a transaction, preparing for audit, or navigating

cross-border IP and tax rules, this discussion will equip you with the

tools to bridge perspectives and manage valuation complexity with confidence.

Hear from seasoned experts as they unpack common challenges and share practical

insights for navigating complex IP/IA-driven transactions.

Key focus areas:

-

Gain clarity on the latest IP and IA valuation requirements and their practical application in M&A transactions, supported by real-world examples.

-

Explore how IP strategy and due diligence can uncover hidden value and potential risks that impact deal structure and value.

-

Learn how to identify and articulate key IA value drivers and commercial considerations and how these can inform more robust tax and transfer pricing valuations.

-

Understand how IP, valuation, and tax considerations intersect and why it’s essential to align them early in the deal process to avoid compliance risks and post-deal surprises.

Admin details

-

Fee: $163.50 (incl.GST)

-

Venue: Revenue House, Level 5 Auditorium, 55 Newton Road, Singapore 307987