Other Tax Related Programmes

UPCOMING PROGRAMMES

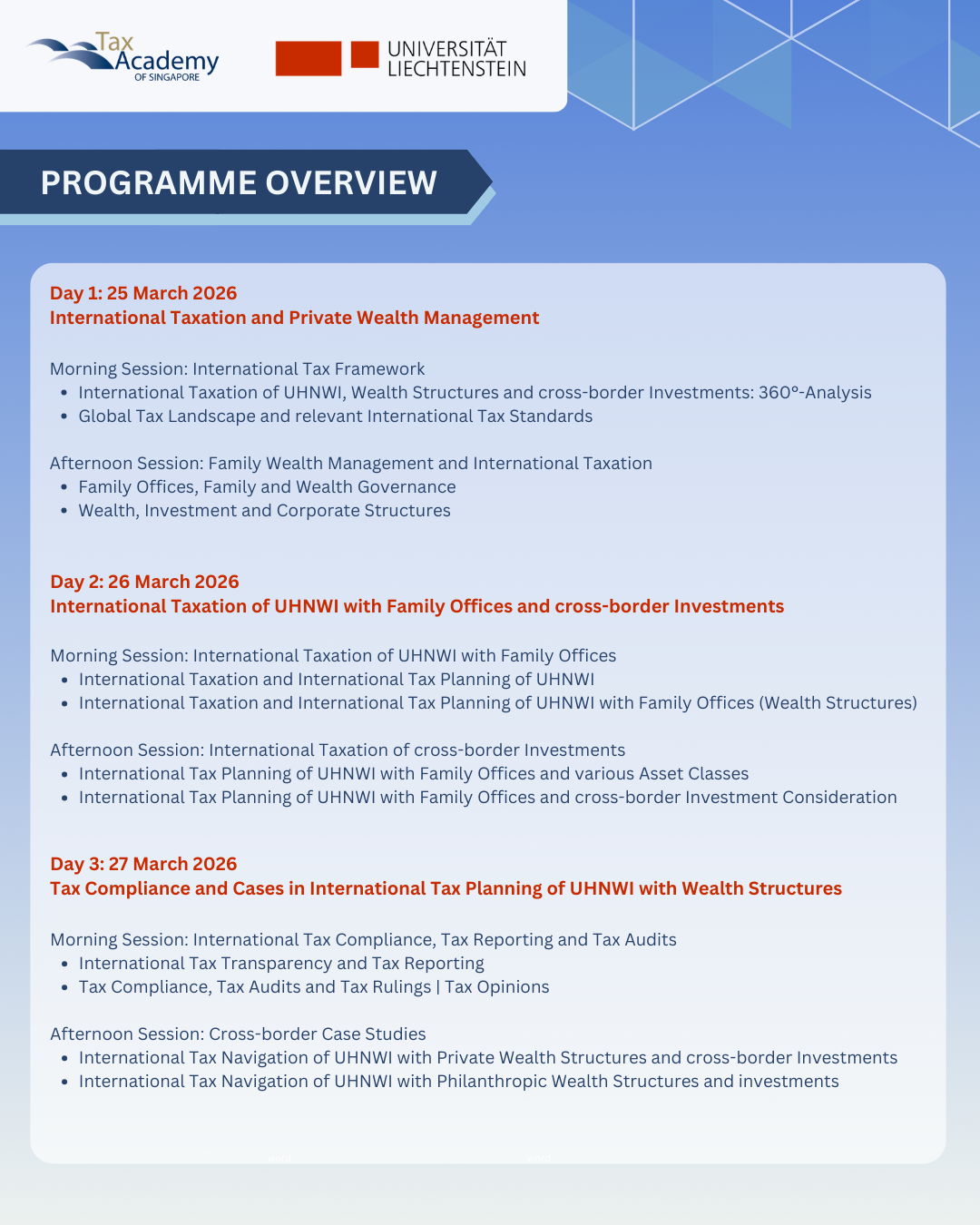

International Taxation of Ultra-High-Net-Worth Individual, Family Offices and Trusts with Cross-Border Investments

As Singapore continues to establish itself as a premier global wealth management hub, this 3-day programme will provide in-depth coverage of critical areas including international tax frameworks, family wealth management, UHNWI taxation, cross-border investments, compliance, reporting, and real-world case studies. Don't miss this opportunity to enhance your expertise in one of the most specialised and rapidly evolving areas of international taxation!

𝗣𝗿𝗼𝗴𝗿𝗮𝗺𝗺𝗲 𝗗𝗮𝘁𝗲𝘀: 25 to 27 March 2026 (in-person at Revenue House)

𝗦𝗽𝗲𝗮𝗸𝗲𝗿𝘀: This programme features renowned experts including Professor Martin Wenz from the Universität Liechtenstein, Edmund Leow, SC from Dentons Rodyk, Chan Xue Pei from Forvis Mazars, Han Junwei from Allen & Gledhill LLP, Lim Ping Ping from LGT Private Banking and Goh Eng-Cher from J.P. Morgan Private Bank, who will provide invaluable perspectives into the world of international taxation for high-net-worth clients.

𝗙𝗲𝗲𝘀: $𝟮,𝟳𝟮𝟱 (𝗶𝗻𝗰𝗹𝘂𝘀𝗶𝘃𝗲 𝗼𝗳 𝟵% 𝗚𝗦𝗧) 𝘓𝘪𝘮𝘪𝘵𝘦𝘥 𝘴𝘦𝘢𝘵𝘴 𝘢𝘷𝘢𝘪𝘭𝘢𝘣𝘭𝘦 - 𝘴𝘦𝘤𝘶𝘳𝘦 𝘺𝘰𝘶𝘳 𝘱𝘭𝘢𝘤𝘦 𝘵𝘰𝘥𝘢𝘺!

Programme Details

Understanding BEPS Programme

Join this blended programme through self-paced e-learning videos before attending a 2-day workshop!

Learning Takeways

-

Overview of BEPS developments

-

Practical understanding of the Pillar 1 and Pillar 2 rules

-

Understanding of the genesis and rationale of key BEPS initiatives

Admission requirements

-

Basic knowledge of Income Tax and International Tax

-

1 to 2 years of working experience in tax

The next intake will be held in 2nd half of year 2026. Please register your interest below:

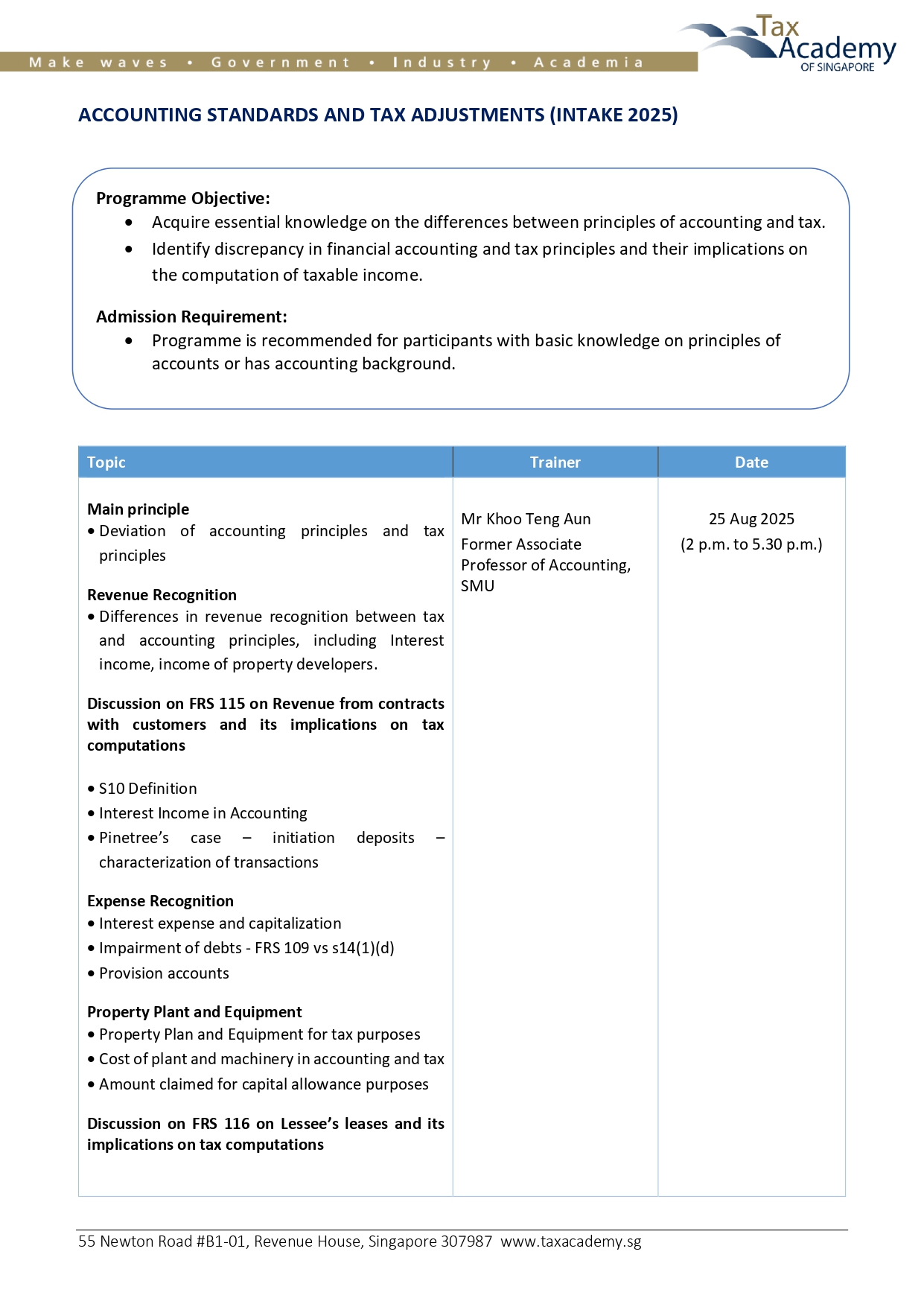

Accounting Standards and Tax Adjustments

Register Now!

Join us in this workshop if you would like to learn about the impact of financial accounting on tax computations. This workshop will be facilitated by Mr Khoo Teng Aun, former Associate Professor of Accounting at Singapore Management University.

Registration is OPEN for intake 2025. The next intake for this course will be in 2026.

Programme Details

Programme on Property Tax Valuation

Join us in this 1-day workshop to gain a deeper understanding of how the Annual Values for different types of properties are valued or assessed using various valuation methods and the statutorily prescribed bases of assessment. The workshop will be facilitated by Ms Ang Sock Tiang, former Chief Valuer.

Next Intake to be advised.