The International Tax Disputes Day

Post Conference Highlights on International Tax Disputes Day: The Asian and Global Landscape, 22 May 2025

"Singapore, if you think about the topic of tax certainty, is one of the capitals, the lighthouse of international tax certainty, one of the capitals where tax certainty isn't just talked about but it's lived. It lives in our Inland Revenue approaches, so there's a lot that the world can learn…”

“(Tax Academy of Singapore) is a great institution to have, it’s a great idea to bring practitioners together, to bring people from tax administrations, from universities together…”

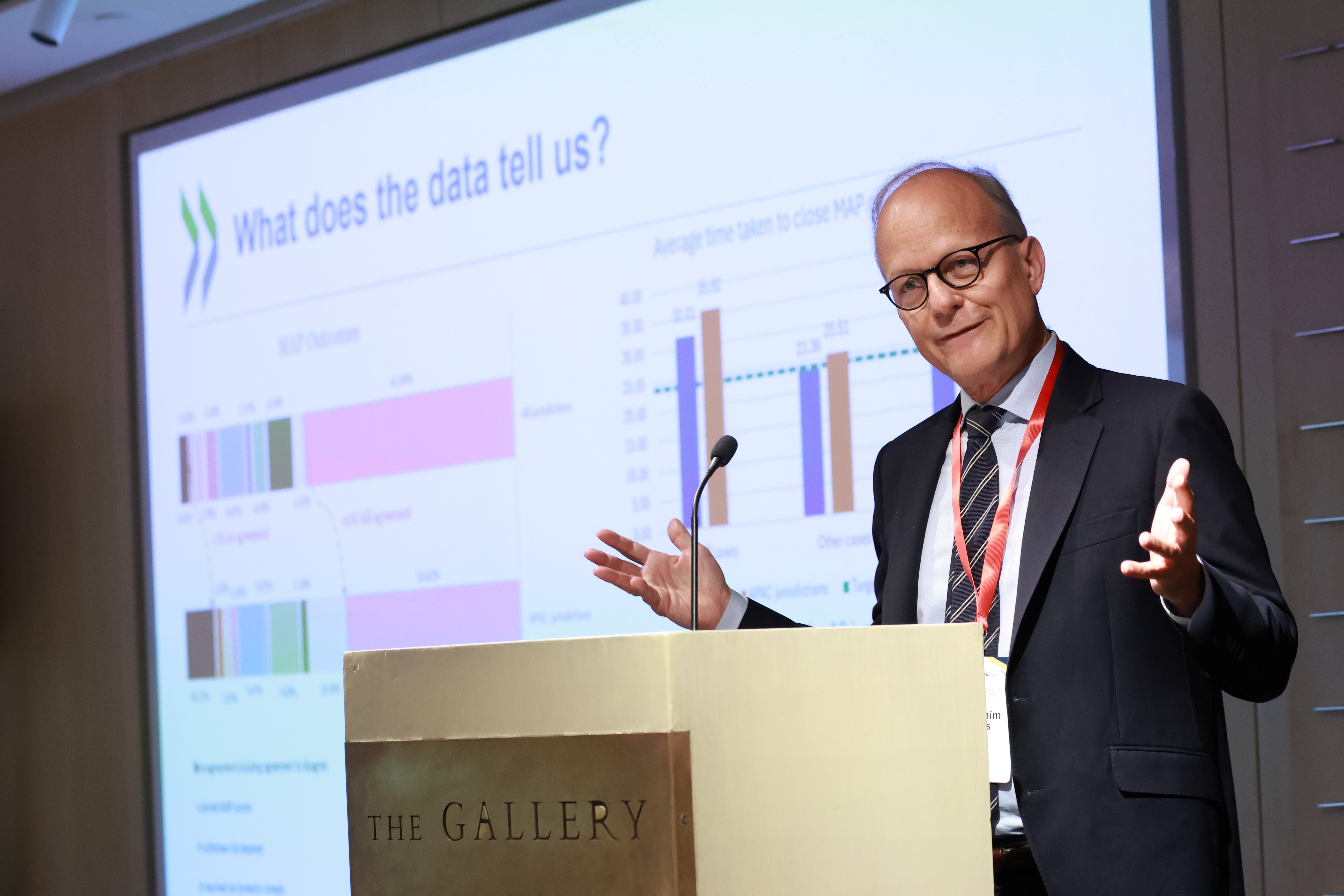

Hear more from the star of our tax community, Dr. Achim Pross, Deputy Director, Centre for Tax Policy and Administration, OECD – Doorstop interview

Interested to hear more on the conference's keynote speeches? Purchase access to the recorded video now!

Singapore stands as a beacon of tax certainty, where theory meets practice through IRAS' innovative approaches. At the International Tax Disputes Day conference on 22 May 2025, Tax Academy brought together over 200 distinguished professionals - including 70 senior partners and C-suite executives - to explore how tax certainty drives sustainable economic development. This high-level gathering exemplified our commitment to bridging expertise across tax administration, practice, and academia.

In his opening address, IRAS Commissioner and CEO Mr Ow Fook Chuen highlighted Singapore's practical commitment to tax certainty. From our extensive treaty network to proactive dispute prevention measures, Singapore is building a tax ecosystem that gives businesses confidence to operate in an increasingly complex global environment.

Dr Achim Pross's keynote highlighted APAC's distinctive approach to tax disputes: despite its significant economic weight - one-third of Inclusive Framework GDP - the region shows remarkably few MAP cases, demonstrating its success in dispute prevention over resolution.

The conference featured dynamic discussions from 19 distinguished speakers - a diverse mix of academics, practitioners, and policy makers from Singapore and overseas. Beyond intellectual discourse, the event provided an invaluable platform for networking, fostering connections between local and international tax professionals including students of Tax Academy NextGen awardees.

Tax Academy would like to thank all speakers, panellists, guests and participants for making this conference a success!

Opening Address by Mr. Ow Fook Chuen, Commissioner/CEO, IRAS

Future of OECD Tax Certainty agenda and dispute prevention and resolution by Dr. Achim Pross, Deputy Director, Centre for Tax Policy and Administration, OECD

Current practical challenges of dispute prevention and resolution by Prof. Dr. Robert Danon, Head, Tax Policy Center, University of Lausanne and Founding Partner of DANON

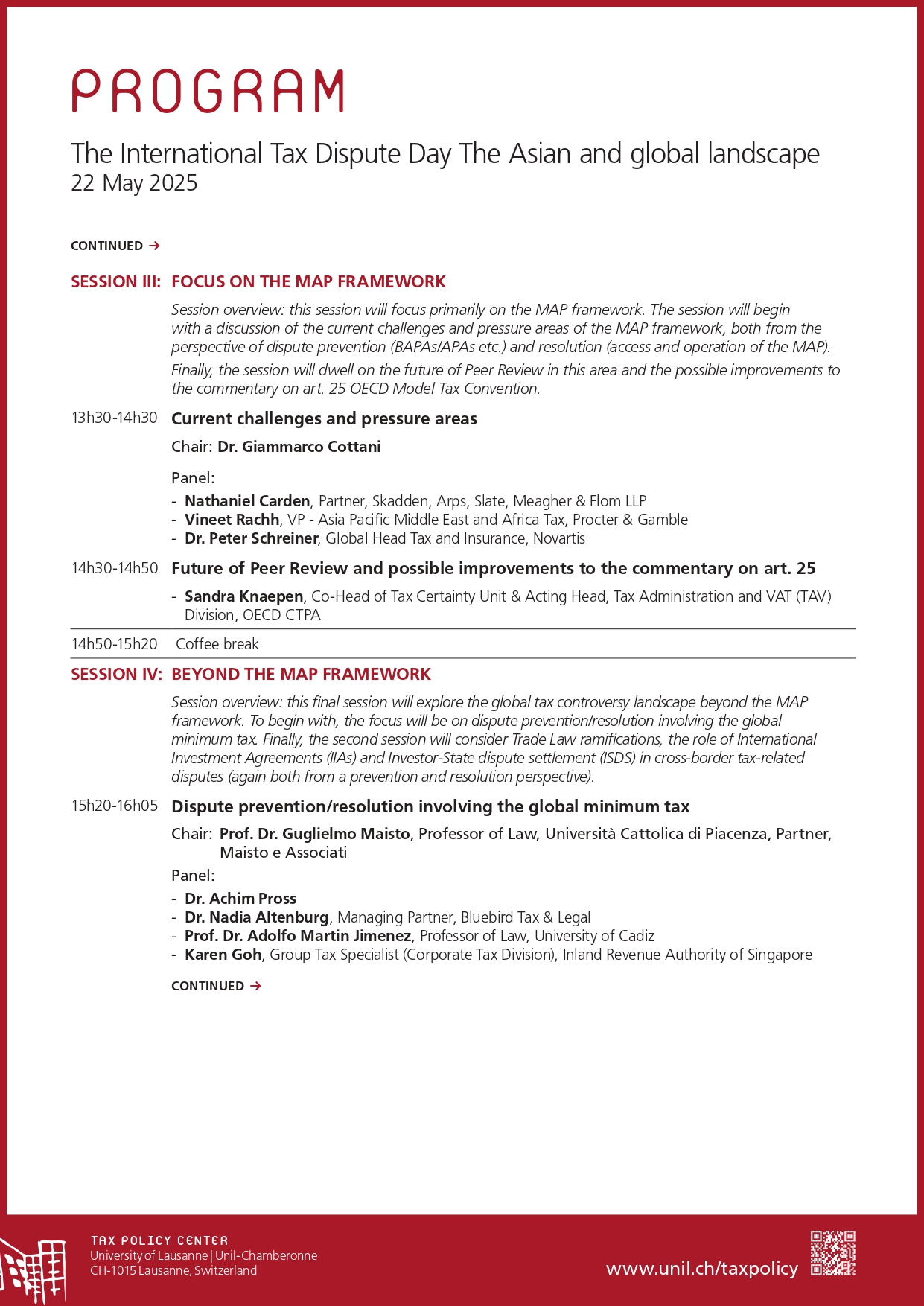

Future of Peer Review and possible improvements to the commentary on Article 25 by Ms. Sandra Knaepen, Deputy Head of the Tax Administration and VAT Division, Co-head of the Tax Certainty Unit, OECD

Left to right: Mr. Dennis Lui (Deputy Commissioner, IRAS/CEO, Tax Academy of Singapore), Prof. Dr. Robert Danon, Dr. Achim Pross, Mr. Ow Fook Chuen

Left to right: Dr. Giammarco Cottani, Mr. Mukesh Butani, Ms. Anne Gordon

Left to right: Mr. Mukesh Butani, Prof. Dr. Robert Danon, Ms. Seema Kejriwal Jariwala, Dr. Niv Tadmore, Ms. Sarah Lim

Left to right: Dr. Niv Tadmore, Dr. Giammarco Cottani, Mr. Justin Campolieta

Left to right: Dr. Peter Schreiner, Mr. Vineet Rachh, Dr. Giammarco Cottani, Mr. Nathaniel Carden

This panel was moderated virtually by Prof. Dr. Guglielmo Maisto. Left to right: Ms. Karen Goh, Dr. Achim Pross, Dr. Nadia Altenburg, Prof. Dr. Adolfo Martin Jimenez

Left to right: Ms. Z. J. Jennifer Lim, Ms. Fereshte D Sethna, Prof. Dr. Robert Danon, Mr. Riyaz Dattu

NextGen Award winners

Conference Brochure