Tax Academy Conference 2023

Navigating BEPS 2.0 - Opportunities and Challenges

Post Conference Highlights

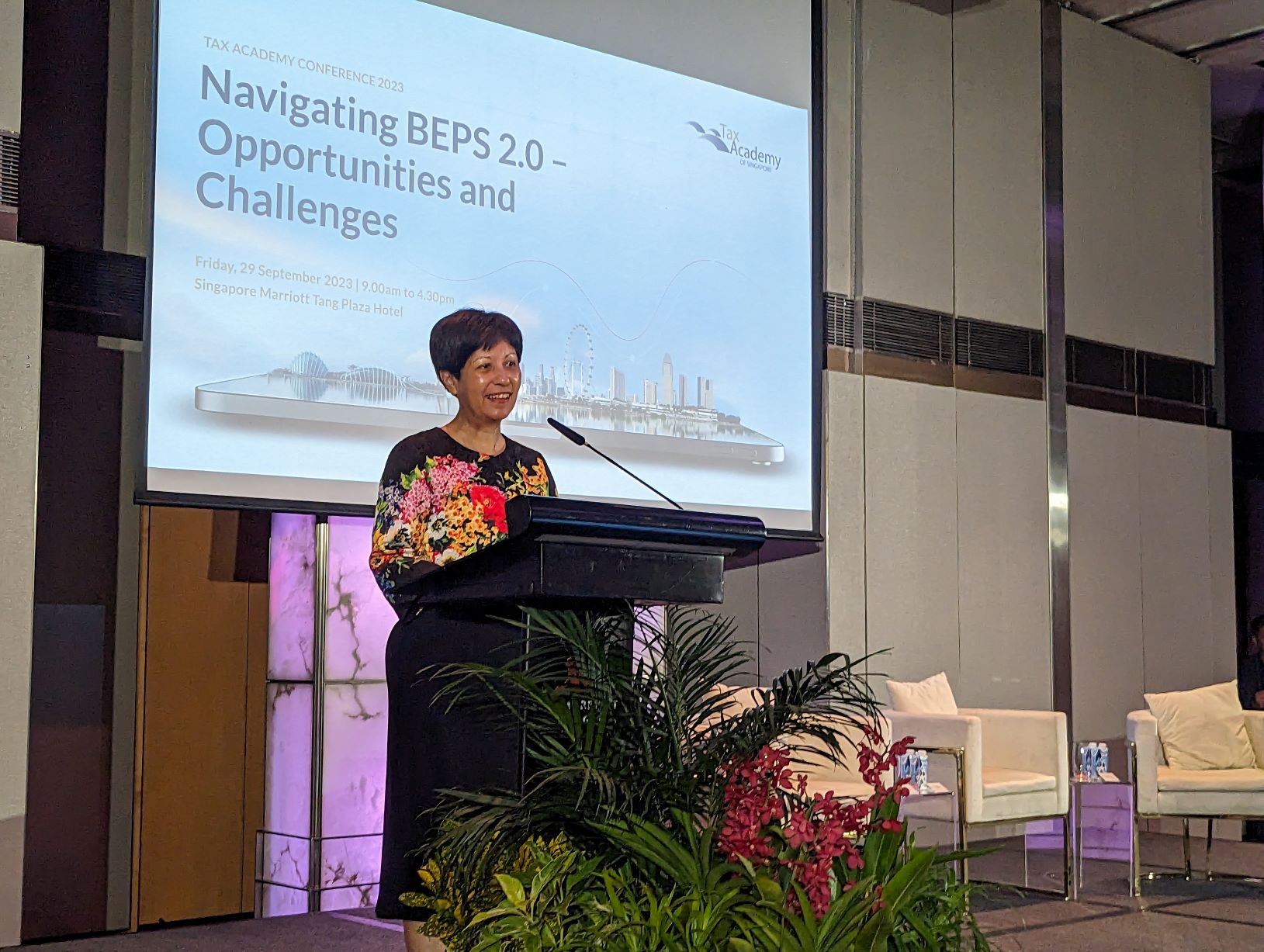

Tax Academy held a successful in-person conference, “Navigating BEPS 2.0 – Opportunities and Challenges” on 29 September. Policy makers and tax professionals shared the stage to discuss global tax developments and how BEPS 2.0 developments will affect businesses and the tax administrations.

Guest-of-Honour, Ms Indranee Rajah, Minister in the Prime Minister’s Office, Second Minister for Finance and National Development delivered the opening address at the conference. About 250 conference attendees took away a key message that Singapore will continue to strengthen its competitiveness in a post-BEPS 2.0 environment and ensure continued ease of doing business for enterprises in Singapore, as we align our regime with the internationally agreed standards.

Opening Address by Minister Indranee Rajah

Opening Address by Minister Indranee Rajah

BEPS 2.0 aims to address tax challenges arising from the digitalization of the economy. Pillar One involves reallocating taxing rights to market jurisdictions, while Pillar Two establishes a global minimum tax rate to prevent large multi-national companies from shifting profits to low-tax jurisdictions.

The conference keynote speaker Dr Achim Pross, Deputy Director of the OECD Centre for Tax Policy and Administration, shared how the Inclusive Framework, comprising more than 140 jurisdictions, collaborated together to design the new global tax rules, so as to bring some stability to the international taxation and inevitably promote tax certainty.

Keynote Speaker, Dr Achim Pross on “The Path Ahead for BEPS 2.0”

Keynote Speaker, Dr Achim Pross on “The Path Ahead for BEPS 2.0”

Plenary Session “Developments on Pillar 1 Multilateral Convention”

Panellists debated on the opportunities and challenges arising from the complexities for Pillar 1.

Plenary Session “Developments on Pillar 1 Multilateral Convention”

Panellists debated on the opportunities and challenges arising from the complexities for Pillar 1.

Plenary Session “Navigating Pillar 2 Tax Changes for The MNEs”

Panellists shared from the countries’ perspectives on Pillar 2 and its implications on businesses

Plenary Session “Navigating Pillar 2 Tax Changes for The MNEs”

Panellists shared from the countries’ perspectives on Pillar 2 and its implications on businesses

While the future of BEPS 2.0 presents challenges, it certainly has the potential to improve the international tax system and create a level playing field for businesses by ensuring that all companies, regardless of their size or location, pay a fair share of taxes.

Tax Academy would like to thank all speakers, panelists, guests and participants for making this conference a success! We hope to see you at our next event.